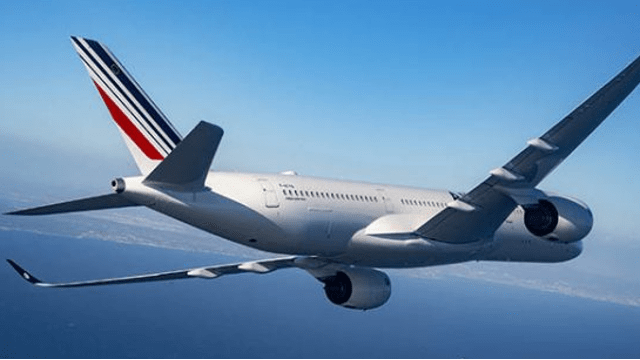

In 2023, Air France-KLM achieved an impressive financial performance, recording historic annual sales of 30 billion euros, an increase of 14% on the previous year, despite a net loss in the fourth quarter attributed to geopolitical conflicts in Africa and the Middle East. The group posted a net profit of 934 million euros, surpassing the 728 million euros of 2022, a load factor of 87.3%, up 3.3 points, and an operating margin that reached 7.5%, compared with 4.5% the previous year. In addition, Air France-KLM reduced its net debt by 1.3 billion euros, posting positive equity of 500 million euros, a clear improvement on the negative situation of 2.5 billion euros in 2022.

However, the market reacted negatively to the announcement, with the share price falling by over 10%, mainly due to an unexpected net loss of 256 million euros in the fourth quarter. This loss is attributed to geopolitical tensions affecting profitable routes, as well as to supply chain problems that hampered the maintenance of certain engines.

With 93.5 million passengers carried in 2023, the Group operated at 7% lower capacity than before the pandemic, and in the fourth quarter, load factor fell slightly to 85.3%.

For 2024, Air France-KLM expects unit costs to rise by 4% in the first quarter, before stabilizing at between 1% and 2% over the year. Group capacity should grow by 5%, with Transavia expected to make a significant contribution to future Group profits. Air France-KLM also anticipates the delivery of 17 new Airbus and Boeing aircraft, including the first A321neo for KLM.

Source: Air Journal

Comments0

Please log in to see or add a comment

Suggested Articles